A few years ago, one of my friends confessed something over coffee. She leaned forward. Her voice fell to a hush: “I love my kids, but from a financial standpoint, I regret having them.”

My friend is a tenured professor. She’s published books with major presses, including Oxford. People beg her to speak at conferences.

Despite all this, her family is barely getting by. (Her husband is also a highly-regarded professor in engineering.) When she was done talking, her face glowed with shame.

It’s a common story these days.

We can’t afford to live anymore.

Here’s something that might surprise you: The average cost of living in the U.S. far exceeds the average income of most professionals. We’re talking about nurses and social workers, firefighters and police officers, school teachers and pediatricians, even carpenters and engineers.

They’re the ones who keep society running, and they currently don’t make enough to support their families.

Take a look at the average monthly living costs for a family of four. These are extremely conservative estimates gathered from multiple cost of living calculators, plus my own observations:

Housing: $1,500

Transportation (including gas): $800

Food: $1,000

Utilities: $400

Phones: $150

Entertainment: $50

Clothing: $200

Healthcare: $400

Emergency savings: $500

Total: $5,000

The median household income stands at $5,264 per month before taxes. That leaves just under $4,000 after taxes, and it doesn’t include deductions for 401K and basic health insurance — or student loans.

All things considered, the average household is sinking into debt by about a thousand dollars per month.

The average household requires two incomes now.

Households with two incomes used to have extra cash to spend on things like vacations or private school tuition.

That’s not true anymore.

Two years ago, The New York Times reported on the average incomes and expenses of parents with two children. Time and again, they found that even two incomes barely brings in enough cash, since you wind up paying anywhere from $500 to $2,000 a month for childcare.

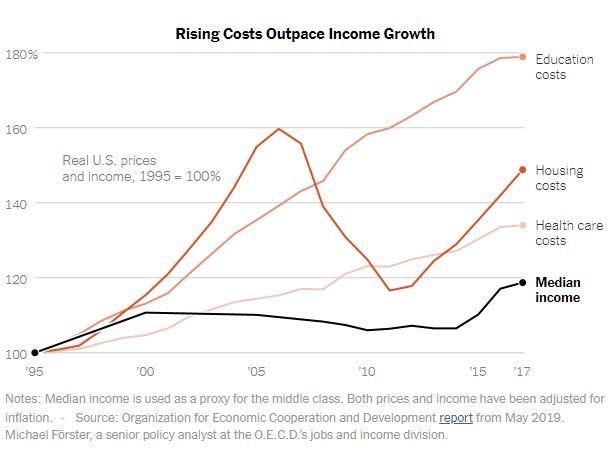

The reason is simple. The average job hasn’t kept up with the cost of living. It doesn’t even come close:

Basically, half of one parent’s monthly income covers daycare, and the rest goes to offset the cost of living. It’s pretty brutal. These days, the luckiest families break even. Everyone else is still going into debt, just not as much as they would be with a single income.

Starting a family has become a luxury.

CNN has a new online calculator called “How much will it cost to raise your child?” It’s fun to play with, in a perverse kind of way. Here’s how much it’s going to cost me to raise my daughter:

According to calculators like this, having just one kid adds about $17,000 a year to your annual cost of living. After all, you have to feed and clothe them. You have to move into a bigger house or apartment.

This might explain why the U.S. birthrate is the lowest it’s been in 32 years. More than 40 percent of millennials report putting off children and buying homes because of financial instability.

This is going to have consequences for baby boomers. They should care, if only for selfish reasons. According to Joseph Coughlin of Forbes, it means they’re not going to be able to sell their homes. That’s important because older people typically want to downsize after they retire and cash in on their equity. Here’s how Coughlin imagines that conversation going:

Boomer Seller: The town has great schools.

Millennial Buyer: I don’t have kids.

Boomer Seller: The house has three bedrooms. My husband and I have enjoyed it for years.

Millennial Buyer: I live alone…with my dog.

Boomer Seller: Well, there is a big, wonderful yard for your dog to play in.

Millennial Buyer: It’s a very small dog.

In other words, not great.

Sorry, boomers.

The wealthy engage in financial gaslighting.

Gaslighting is when you construct a fake reality to excuse yourself from your own sinister actions and behaviors.

Abusers do it all the time.

Hoarding wealth is a kind of abuse the wealthy inflict on the entire world. To excuse it, they construct a series of lies that allow them to blame everyone for their own financial problems.

It’s pretty easy to distract someone from systemic inequality and make them feel guilty about a financial situation that’s not their fault. You just have to talk about flat screen televisions and smartphones, even if those make up a tiny fraction of someone’s monthly budget. You call them lazy, and tell them they spend too much time watching Netflix.

You browbeat them for not investing in stocks, or pouring money into volatile assets. You shame them for working meaningful jobs that contribute something to civilization, instead of becoming rich so they can opt out of the economy altogether.

You accuse them of resenting wealth, and tell them they have a poor attitude toward money (whatever that means). Then you pump them full of fairy tales, about how someone made a fortune from nothing. Finally, you tell them money doesn’t matter, and that no amount of it will ever make them happy unless they learn to love themselves. It works wonders, because it confuses the hell out of people. Sufficiently gaslight someone over their finances, and they won’t know what to think anymore.

That’s the point.

Financial gaslighting is doing serious damage.

There’s millions of desperate people out there. If they have a job, it doesn’t pay enough. Here’s the advice they’re getting:

- Invest in stocks.

- Start a side hustle.

- Go viral.

- Start your own company.

- Spend less money.

No offense, but this all sounds kind of like throwing a drowning person a paddle made out of lead. It might look helpful, but it’s not. It does nothing but shift responsibilities from governments and economic structures to overwhelmed, overburdened individuals.

It’s great to make extra income off a side hustle, or turn your talents into a job that doesn’t exist yet. It’s great to be exceptional, but being exceptional by definition means that not everyone can do it. You don’t solve poverty and wage gaps by expecting everyone to be a genius.

Let’s get real for a minute.

The economy needs baristas. It needs cashiers and servers and farmers. Society needs police officers and school teachers. It needs nurses and social workers. When someone gaslights them about their finances because they can’t pay their bills, they’re pretending we can live in a world without them. The truth is, we need them far more than we do lifestyle vloggers. The solution to widespread financial desperation isn’t to turn everyone into millionaire YouTubers and Instagram models.

It’s to pay them more.