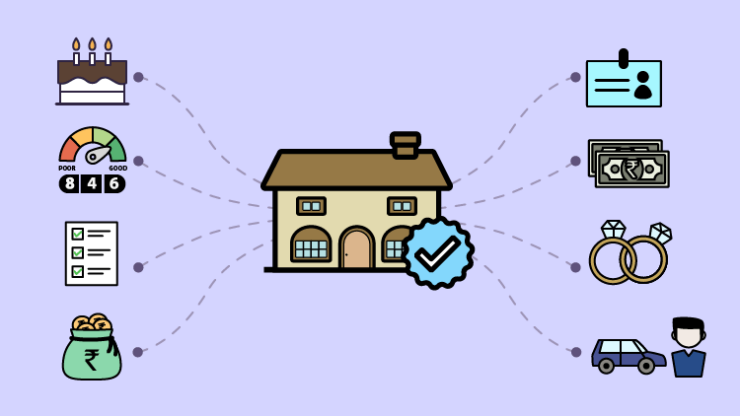

A home loan is, in many ways, one of the most straightforward loans to get. Housing is a priority sector, and banks have liberalized rules to make it convenient for everyone to get a home loan. However, every bank has its eligibility norms that applicants have to satisfy to get a home loan. Let us look at eight factors that could impact your home loan eligibility.

Your Age

A home loan is a long-term commitment. The amounts involved are huge, and hence, banks offer extended repayment terms that could even go up to 30 years. But, at the same time, they also stipulate that the repayment should not extend beyond the borrowers’ age of 75 years. Hence, your age can be a limiting factor if you go for a home loan late in life.

For example, the SBI Home Loan Eligibility Criteria state that the home loan applicant should be between 18 and 70. Therefore, a person aged 30 at the time of the application can get repayment tenure of 35 years, whereas a 55-year old applicant cannot get more than 20 years to repay the loan.

Your Employment

Banks offer home loans to salaried and self-employed persons. Salaried employees have a specific retirement age, whereas self-employed people do not have such liberties. However, it can affect the salaried person adversely because of the lack of income generation after retirement. Therefore, banks try to stipulate the repayment schedule in such a way as to coincide with the retirement age. It is not so in self-employed persons where the repayment can extend much beyond the salaried employee’s retirement age.

Your income

Your income is a critical aspect that every bank considers when estimating your home loan eligibility. Banks look for a regular source of income to enable them to judge your repayment capacity. The salaried employees have an advantage in this aspect because they have a guaranteed source of income.

Among salaried persons, those working with Government departments, PSUs, and reputed private sector organizations and corporates benefit because of their job stability. On the other hand, self-employed individuals are at a disadvantage because they do not have a

regular and guaranteed source of income. Automatically, it increases their risk perception, and banks stipulate higher interest rates on such home loans.

Your existing loan obligations

While your income is a critical factor in determining your home loan eligibility, it is not the deciding factor. Instead, banks consider the existing loan and statutory obligations when determining your repayment capacity. It is also known in banking circles as the EMI/NMI

ratio (Equated Monthly Instalment to Net Monthly Income). The thumb rule is that the EMI/NMI ratio should be at least 50%. This is because the EMI includes the instalment amount for the proposed home loan. Therefore, the higher the EMI to NMI ratio, the lower is your home loan eligibility.

The number of dependents

As you complete the home loan application, you will come across this column where you have to state the number of dependents. It might seem to be trivial information, but it can affect your home loan eligibility. Banks use this info to determine your disposable income and arrive at your repayment capacity. The more the dependents, the higher your expenses will be. It thus translates into a lower disposable income and a weaker repayment capacity.

Your credit rating

A home loan is a secured loan backed by more than 100% security. Therefore, the banks are not very particular about the applicant having excellent credit scores. The ICICI Home Loan Eligibility Criteria state that the applicant should have a reasonably good credit history. The bank considers home loan applications from individuals having a CIBIL score of 650 and above. Some banks even go as low as 550 if the applicant has guaranteed income sources and the property value is sufficient to cover any eventuality.

The credit rating can be a limiting factor for home loans as they influence the interest rate applicable to the individual home loan. For example, an applicant with a credit score of 650 will have to pay a higher interest rate on the home loan than a borrower with a credit score of more than 750 or 800.

The value of the property

Banks usually approve home loans up to 90% of the house’s value, especially if it is a new house or has a reasonably good residual life. Banks have experienced valuation experts on their panel who inspect and evaluate the house to determine the property’s market value.

Generally, these valuation engineers offer three values, market value, distress sale value, and a bank-acceptable value. The market value is the highest of the three, whereas the distress sales value is the value that banks can recover if it decides to sell the possess and sell the house in case of default by the borrower. Therefore, it is the lowest of the three. The bank-acceptable value is a reasonable value for the house that is the average of the market and distress sales values. Banks usually offer 75% to 90% of the bank-acceptable value of the property.

The title to the property

Banks have experienced lawyers on their panel to determine the title to the property. They check the property records at the respective Sub Registrar Office based on the documents you provide. It gives the banks an idea of whether the property is free from any defect or encumbrances that could affect the transfer of title to the property.

Your home is the prime security for the home loan, and borrowers have to create an equitable mortgage of the property favoring the bank. If there is a defect in the title, the equitable mortgage will not be valid, and banks will not have any hold on the security. Hence, ascertaining the clear and marketable title to the property is one of the crucial home loan eligibility criteria.

Final Thoughts

If you go through the SBI home loan eligibility or the ICICI home loan eligibility criteria, they might not include the points discussed above in detail. However, the banks have a robust internal mechanism that comes to the fore when determining the individual home loan eligibility of the specific borrower. Therefore, all the eight factors discussed here have an immediate bearing on your home loan eligibility and affect it in one way or another.